New Delhi, Aug 27 (IANS) The US Federal Reserve may start rolling back its ultra-low rate monetary policy by the end of this year, Fed chairman Jerome Powell indicated Friday. In a much-anticipated speech as part of the Fed's annual Jackson Hole, Wyoming, symposium, he noted that the Federal Reserve would continue its asset purchases at the current pace until it sees substantial further progress toward maximum employment and price stability goals, measured since last December, when it first articulated this guidance. The "substantial further progress" test has been met for inflation, he said. There has also been clear progress toward maximum employment. "At the FOMC's recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year," Powell said. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant, he said. "We will be carefully assessing incoming data and the evolving risks. Even after our asset purchases end, our elevated holdings of longer-term securities will continue to support accommodative financial conditions," he added.

US Fed may taper off easing monetary policy by year end

- by Rinku

- August 27, 2021 2 minutes

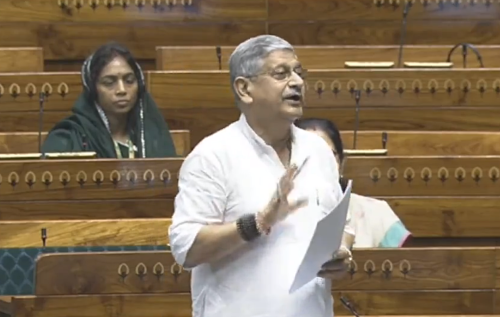

U.S. Federal Reserve Chairman Jerome Powell. (Al Drago/Pool via Xinhua) /IANS