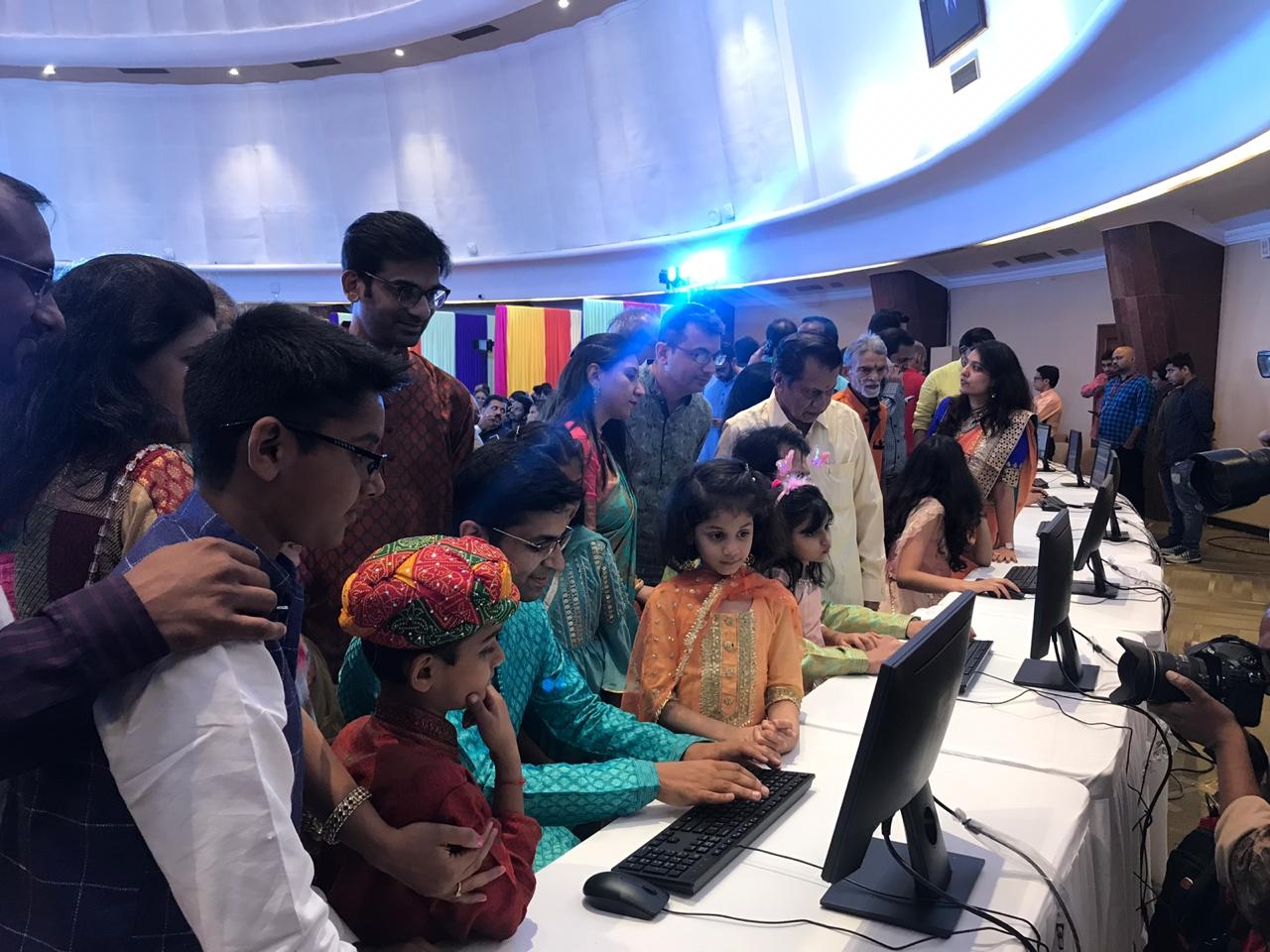

The week gone by ended with losses. It also brought Hindu calendar year Vikram Samvat 2075 to an end. The Sensex lost 240.32 points or 0.61 per cent to close at 39,058.06, while the Nifty lost 77.95 points or 0.67 per cent to close at 11,583.90. The broader indices saw BSE100, BSE200 and BSE500 lose 0.75 per cent, 0.61 per cent and 0.56 per cent, respectively. The BSE Midcap lost 0.54 per cent, while the BSE Smallcap gained 0.20 per cent. The markets gained on two trading days and lost on the remaining two. Monday was a holiday on account of Assembly elections in Maharashtra and Haryana. Dow Jones gained 110.11 points or 0.41 per cent to close at 26,958.06. The Indian rupee gained 26 paise or 0.41 per cent to close at Rs 70.88 to the US dollar. Vikram Samvat 2075 saw the benchmark indices register gains. The Sensex gained 3,820.39 points or 10.84 per cent to close at 39,058.06. The Nifty gained 985.5 points or 9.29 per cent to close at 11,583.90. The samvat had begun on Wednesday, November 7, 2018. Smallcap and Midcap indices lost ground. It was a tough year for the markets and they struggled for some time before some momentum came post-Balakot action in February and the resounding mandate to the NDA in May. After reaching the new all-time high in May, it saw corrections on global cues, slowdown in the Indian economy, the China-US trade war, and so on. Vikram Samvat begins on Sunday, October 27, and is expected to see benchmark indices perform better than the previous year. The slowdown notwithstanding, the economy is expected to rebound in a couple of quarters on the back of tax cuts already announced and some more measures that may or may not be announced. The oil and gas sector and the BFSI space could see sharp recovery. The former on the expected divestment of BPCL, which would lead to a re-rating of the sector, and the latter because it has been beaten down with a number of companies involved in unhealthy practices. Some names, for example, include DHFL, ILFS, Yes Bank and the Indiabulls group of companies. Insurance in India is highly under-penetrated and all the listed companies in the space have seen huge interest in recent times. Many companies have raised funds through stake sale via offer for sale and they were lapped up on the bourses. Ayushman Bharat has shown the impact of affordable insurance for the people and the healthcare sector. This is also a key indicator for the expected growth in the insurance sector, particularly life, where even protection is abysmally at low levels. PSU stocks have reflected interest by investors and many companies have seen their stock prices move up, buoyed by the performance of IRCTC on listing on October 14. Shares of IRCTC, issued at Rs 320, closed at Rs 899.40 with the gain of Rs 579.40 or 181 per cent. The week ahead sees 'muhurat trading' on Sunday, October 27, followed by a trading holiday on Monday. Thursday will see October futures expire. The current value of the Nifty at 11,583.90 points is marginally higher than the series open by a mere 12.70 points or 0.11 per cent. With three trading days to go, the series could go in either direction. But I believe the bulls have an edge with the new Samvat backing them. There are no major fireworks expected, but plenty of light and a change in the sentiment. Use any dips in prices to add to your positions. Wishing all readers a happy Diwali and a prosperous Samvat 2076. (Arun Kejriwal is the founder of Kejriwal Research and Investment Services. The views expressed are personal)