Mumbai, April 24 (IANS) The Indian stock market snapped its two-day gaining streak on Friday with the BSE Sensex losing 500 points. The fall was largely on the back of the weakness in global indices amid reports that an experimental drug 'Remdesivir,' a potential antiviral drug to treat COVID-19 under trials, has failed. Heavy selling pressure on the banking and finance stocks also weighed on the stocks. The S&P BSE Banking index was down 3.30 per cent and the BSE Finance index closed 3.91 per cent lower. Noting that with the weekend ahead, traders were seen winding up long positions built in the last few days, Rahul Sharma, Research Head, Equity99 Advisors said: "Sentiments were also affected by weak global clues after reports Gilead Sciences Inc's antiviral drug, Remdesivir, had failed to help severely ill COVID-19 patients in its first clinical trial." He further said that signs of a new crisis in the mutual-fund industry created new panic among traders today. In a major development in the mutual fund sector, Franklin Templeton Mutual Fund late on Thursday evening announced that it was closing six of its credit funds due to liquidity issues. The Sensex closed at 31,327.22, lower by 535.86 points or 1.68 per cent from the previous close of 31,863.08. It had opened at 31,426.62 and touched an intra-day high of 31,842.24 and a low of 31,278.27 points. The Nifty50 on the National Stock Exchange closed at 9,154.40, lower by 159.50 points or 1.71 per cent from the previous close.

Sensex down 535 points; banking, finance stocks dip

- by Rinku

- April 24, 2020 2 minutes

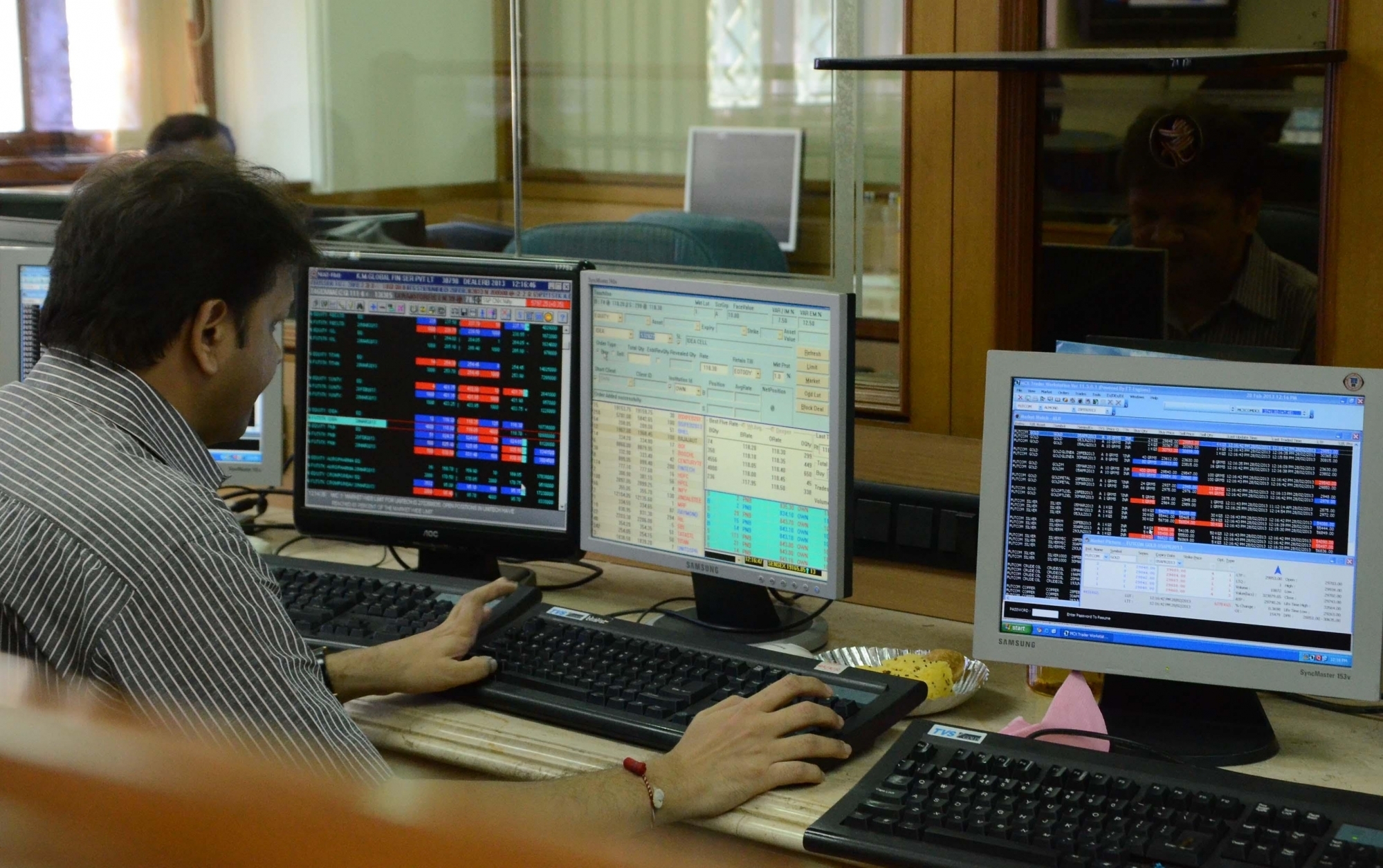

Bombay Stock Exchange. (File Photo: IANS)